In the bustling corridors of modern life, where the clamor of daily responsibilities often drowns out personal well-being, financial planning emerges as an unexpected beacon of serenity. While the concept of managing one’s finances might initially conjure images of spreadsheets and calculators, its implications stretch far beyond mere numbers. This article delves into the intriguing intersection of financial planning and stress reduction, exploring how a well-charted financial course can transform chaos into calm. By unraveling the psychological and emotional layers that bind money management to mental tranquility, we aim to illuminate the pathways through which individuals can reclaim peace of mind in an ever-complex world. As we journey through this exploration, we invite you to consider how financial foresight might just be the key to unlocking a more harmonious existence.

Understanding the Psychological Impact of Financial Uncertainty

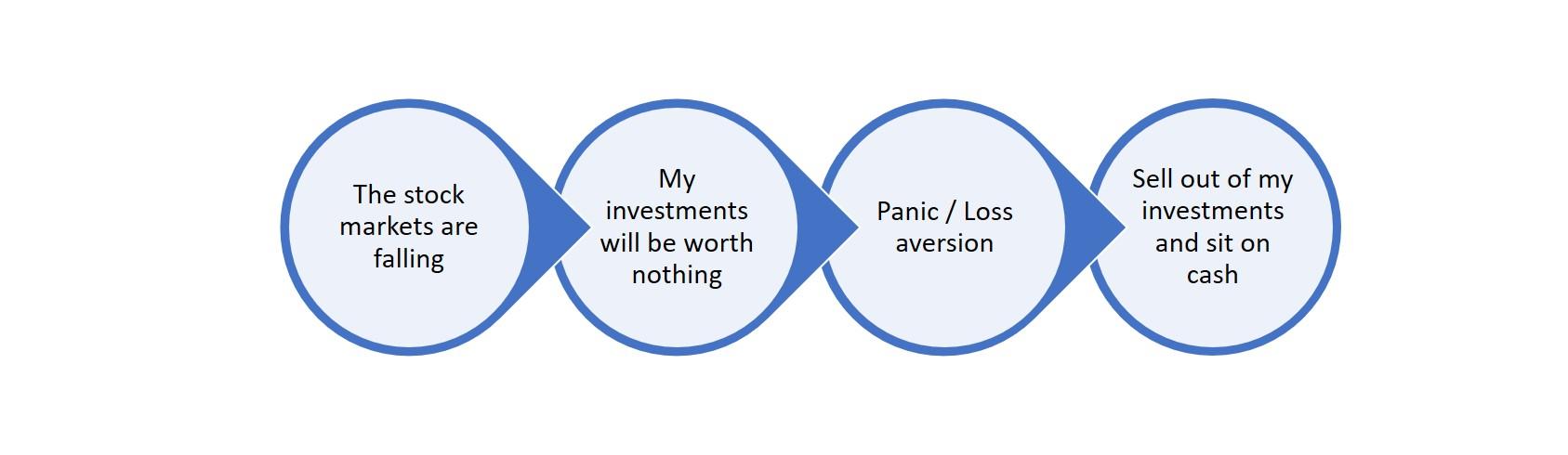

In the labyrinth of life’s uncertainties, financial instability often casts the longest shadow. It intertwines with our mental well-being, creating a delicate balance that can be easily disrupted. The unpredictability of finances can lead to heightened anxiety, sleepless nights, and a pervasive sense of unease. Yet, understanding this intricate relationship offers a path to empowerment. By acknowledging the psychological implications, individuals can take proactive steps to mitigate stress and cultivate a sense of control over their financial futures.

- Clarity through Planning: Establishing a well-defined financial plan serves as a beacon in turbulent times. It provides a clear roadmap, reducing the ambiguity that fuels anxiety.

- Emotional Resilience: Financial planning can enhance emotional resilience by instilling confidence and a sense of preparedness.

- Focus on Priorities: By prioritizing financial goals, individuals can allocate resources effectively, ensuring that essential needs are met without unnecessary strain.

As the mind grapples with the pressures of financial uncertainty, adopting strategic planning not only eases the psychological burden but also fosters a more harmonious relationship with money. This approach empowers individuals to navigate the complexities of financial challenges with greater peace of mind.

Strategic Budgeting: A Pathway to Mental Peace

In a world where financial obligations often feel overwhelming, adopting a strategic approach to budgeting can serve as a vital tool for reducing stress and enhancing overall well-being. By proactively planning and managing finances, individuals can experience a newfound sense of control over their economic landscape. This control fosters mental peace, as uncertainties are minimized and future financial needs are anticipated. A well-crafted budget not only clarifies spending habits but also aligns financial resources with personal values and goals.

Key elements of effective budgeting include:

- Prioritization: Identifying essential expenses and differentiating them from discretionary spending.

- Flexibility: Allowing room for unexpected costs without derailing financial plans.

- Goal Setting: Establishing clear, achievable financial objectives that provide motivation and direction.

By integrating these elements into a financial plan, individuals can transform budgeting from a mundane task into a powerful strategy for achieving peace of mind.

Harnessing Financial Tools for Stress Mitigation

Financial planning serves as a pivotal tool in the journey towards a more serene life, acting as a shield against the unpredictable waves of monetary stress. By establishing a clear roadmap for your financial future, you can cultivate a sense of control and confidence that significantly alleviates anxiety. Embracing a structured approach to managing your finances can help transform potential stressors into manageable tasks. This includes:

- Budgeting: Developing a budget that aligns with your lifestyle and goals.

- Emergency Funds: Creating a financial safety net to cushion unforeseen expenses.

- Debt Management: Strategizing to reduce and eventually eliminate debt burdens.

- Investment Planning: Leveraging investments to build wealth and secure your future.

Each of these elements plays a crucial role in crafting a financial strategy that not only safeguards your assets but also your peace of mind. By proactively addressing potential stress triggers, financial planning becomes a powerful ally in fostering mental well-being and enhancing overall life satisfaction.

Building a Resilient Future through Informed Financial Choices

In today’s fast-paced world, the link between meticulous financial planning and a reduction in stress is becoming increasingly evident. Financial stability acts as a foundation upon which individuals can build a life free from the constant worry of unexpected expenses or economic downturns. By making informed financial choices, people can create a safety net that offers peace of mind. This involves setting realistic budgets, investing wisely, and understanding the nuances of savings plans. Each of these steps helps to mitigate anxiety by providing a clear roadmap for the future.

Consider the benefits of a well-structured financial plan:

- Reduced Anxiety: Knowing that there’s a plan in place for emergencies can alleviate stress.

- Goal Achievement: Structured financial strategies help in setting and reaching personal and professional milestones.

- Improved Decision-Making: With a clear financial picture, individuals can make informed decisions about spending and saving.

- Enhanced Security: A solid financial foundation acts as a buffer against life’s unpredictable challenges.

By embracing these practices, individuals not only secure their financial future but also foster a more balanced and resilient lifestyle.